Business Protection means Business as usual

That’s what many business owners want. A business that flows along, according to plan, building profits and growing. Unfortunately, life has a habit of throwing a curve ball now and again. Key people get ill and may need time away. If shareholders, directors or owners get ill or die the structure of the business can change or even fail. Business protection is there to help you continue with business as usual.

Relevant Life Cover

Most group risk providers are reluctant to write schemes for fewer than 5 members, and then only as part of a registered group risk scheme. Our approach is different. The relevant life policy is a single life, stand-alone death-in-service plan, providing benefits on an individual basis. Key benefits :–Unique individual stand-alone cover– Tax advantages for high earners– Premiums not taxed as a benefit in kind– Allowable as an expense for the employer– Cover now up to 20 times annual salary. There are various advantages to this. For a start, it offers high-earning employees who have substantial pension funds a number of tax advantages. That’s because the lump sum benefits do not form part of the employee’s annual or lifetime pension allowance. And, although the company pays the premiums, they are not normally taxed as a benefit in kind – which can offer huge savings, especially for a higher rate taxpayer. While it is mainly aimed at high earners, it can be suitable for any employee. What’s more, the payments may also be treated as an allowable expense for the employer in calculating their tax liability. Which means it is also particularly suitable for small businesses that do not have enough eligible employees to warrant a group life scheme. Remember, this is based on our understanding of current tax law which could change in the future.

Keyman Insurance

Keyman insurance is simply life insurance on the key person in a business. In a small business, this is usually the owner, the founders or perhaps a key employee or two. These are the people who are crucial to a business the ones whose absence would sink the company. You need key man insurance on those people!

This is How Keyman Insurance Works: A company purchases a life insurance policy on the key employee, pays the premiums and is the beneficiary of the policy. If that person unexpectedly dies, the company receives the insurance payoff. The reason this coverage is important is because the death of a key person in a small company may cause the immediate death of that company. The purpose of key man insurance is to help the company survive the blow of losing the person who makes the business work. The company can use the insurance proceeds for expenses until it can find a replacement person, or, if necessary, pay off debts, distribute money to investors, pay severance to employees and close the business down in an orderly manner. In a tragic situation, keyman insurance gives the company some options other than immediate bankruptcy. If the company is just you and doesn’t have any employees or other people who depend on it, then key man insurance isn’t as necessary. You’ll notice that I didn’t mention your family-don’t confuse keyman insurance with personal life insurance. If you have a spouse and/or children who depend on your income, then you should have personal life insurance for that purpose.

Shareholder Protection

Shareholders acquire shareholder protection insurance because they want to protect their welfare. Shareholder protection insurance also helps other shareholders settle any future problems say for instance the death of one of the shareholders or when a holder gets a serious illness. The help means, the other shareholder will be provided with cash which can be utilized in buying the shares of the deceased or sick shareholder. However, the most benefited people are the family members of the insured shareholder who will receive the inheritance intended for them and by the quickest means possible while avoiding disruption of the company’s business transaction. Shareholder Protection Insurance aims to protect not just the family and the affected shareholder himself, but the welfare of the entire company if selling and transferring take place. Shareholder protection insurance provides a lump sum amount of money (normally equivalent to the share value) in the event of a claim through death or critical illness. With shareholder protection insurance the company takes out a life only or life & critical illness policy for each shareholder to the amount of their shareholding. In the event of a claim, the money is paid directly to the company in order to finance the purchase of the shares from the deceased next of kin. In order for this to happen smoothly, it is advisable to have a shareholder agreement in place which forces the next of kin to sell the shares back to the company. This is sometimes called a cross-option agreement.

Who’d Be Pulling Your Strings If Your Business Partner Died? When a shareholder dies his or her shares will normally pass on to their husband or wife which in the case of many companies would not be ideal. The consequences of this can be catastrophic for the company. For example the new shareholder may want to sit on the board and make detrimental decisions, or they may sell their shares to someone else not seen as a benefit to the other directors. In the case of small partnership companies, loss of a 50% shareholder may mean a huge loss in profits and potentially end the company.

Executive Income Protection

Executive Income Protection can help small business clients by protecting against the financial impact of their employees incapacity on the business. Cover can include the employee’s earnings, dividends and P11D benefits. Additional cover can be arranged at an additional cost to cover employer pension contributions and National Insurance (NI) contributions. An Executive Income Protection plan would pay the monthly benefit to the business in the event of a valid claim, the business can then use this benefit to fund the employee’s ongoing sick pay if they are unable to work as a result of becoming incapacitated due to illness or injury. This can help the employee to meet their financial commitments whilst not leaving them to rely solely on their savings or state benefits.

Business Loan Protection

Many factors can affect your ability to repay a business loan. So it makes good business sense to protect against those that may affect you directly. If your business has outstanding borrowings such as a bank loan, commercial mortgage, director loan accounts or if you have given the bank personal guarantees relating to the business then Business Loan Protection could help you. Business Loan Protection is designed to enable a business to repay specific debt if a key employee or business owner dies or is diagnosed as critically ill before the debt is fully repaid. Business Loan Protection can make sure a business debt secured on business assets or even your family home doesn’t put your assets or home at risk.

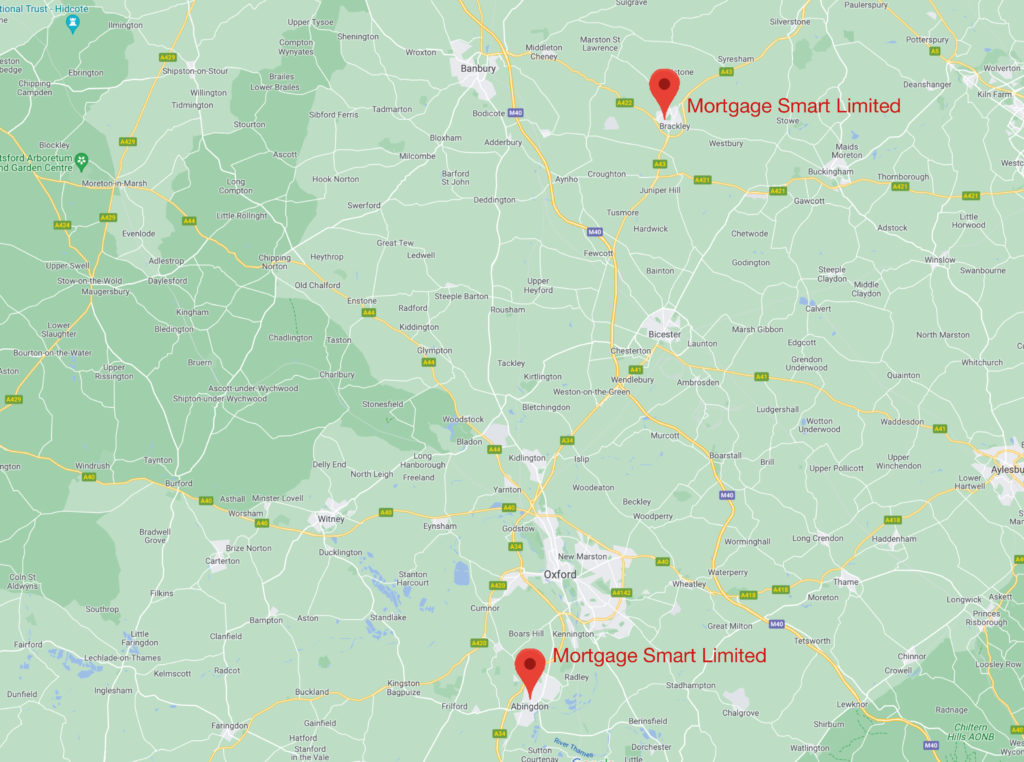

Business Smart is a trading name of Mortgage Smart Ltd which is an Appointed Representative of PRIMIS Mortgage Network which is a trading name of Personal Touch Financial Services Limited. Personal Touch Financial Services Limited is authorised and regulated by the Financial Conduct Authority. Registered in England & Wales, 11754334. Registered Office: 7 Draymans Walk, Brackley, Northants, NN13 6DF No: 12749965.