03/12/2021 by Rachel Smith

Mortgage Protection – A Mochaccino away…

As I was scraping the ice and snow off my car this morning, it occurred to me that if the car doesn’t get me there – I’ve got breakdown cover. They’re a phone call away and it’s a monthly direct debit that I don’t really notice. Equally, if I have an accident on the school run – I’ve got car insurance – a telephone call away from getting the money I need to replace it or repair it– phew!

It’s crucial that my car works so that I can do all things I want and need to do with my family – the school run, getting to the office, get the kids to their after-school clubs and do all the social things we want to each week. Because the alternative is that I stump up thousands of pounds to replace it. I’m guessing I’m not alone in this.

Our family dog is not well now. We’re off to the vets to find out why – again! Thank goodness we pay a monthly direct debit for her insurance to claim on if we need to. Except of course if it’s dental – don’t get me started!

But. how many of us think about our incomes in the same way? If we’re not well like the car or the dog, we can’t work. Our income stops – we can’t earn. It’s crucial that our income does not stop. We need it to pay our mortgage or rent, the car, the after-school clubs, Christmas.

Sure, if you’ve got an emergency fund you can dip into that – but how long would that last? And how long would it take to replace it?

| So, my question today is – if you were signed off sick how long could you last? What emergency fund have you got? What’s your plan? Have you got the Mortgage Protection you need? |

In your employment contract there’s a section that refers to time off work due to sickness and it tells you how long they will pay you if you can’t work. Most employers offer Statutory Sick Pay (SSP)– that’s currently £96.35 a week (2021).

Think about that for a minute – that’s not even going to cover your mortgage let alone food, petrol, electricity. If you’re self-employed – there is no employer to pay you anything – you’re on your own.

Family may ‘help out’ but they’ve got their own bills to pay – how long would they pay their own bills plus yours too? ‘Help out’ might mean to them they’ll help with petrol or fill your freezer with lasagne.

It’s normal for us to buy our coffee out nowadays isn’t it, several time a week. Now I’m not saying that you shouldn’t but, you might be a ‘mochaccino with sprinkles and cream’ away from having peace of mind that your bills are going to be paid if you can’t work because at Mortgage Smart, we make a plan.

At Mortgage Smart, every customer is given the opportunity to make their plan – to set up sickness and accident insurance and protect their income along with other insurances to give you Mortgage Protection. Our expertise and experience will help you find an affordable solution to protect you, your family, and your business.

The monthly benefit you could claim is based on your budget, income and what your employer offers you. A truly individual solution. So, if you think you might like to know more about how it works then we’re just a phone call away. It costs you nothing to get a quote.

A fully protected mortgage includes:

How do other types of Mortgage Protection help you?

Mortgage protection does just that, it’s a monthly insurance payment, helps keep you and your loved ones in your home.

It can pay out a lump sum on death, if you get a serious illness and can give your family an income if you’re not there any more. Mortgage Smart are trained in identifying the right type of mortgage protection cover for you and your unique needs. So, give us a call now, and make sure that you and your family are protected.

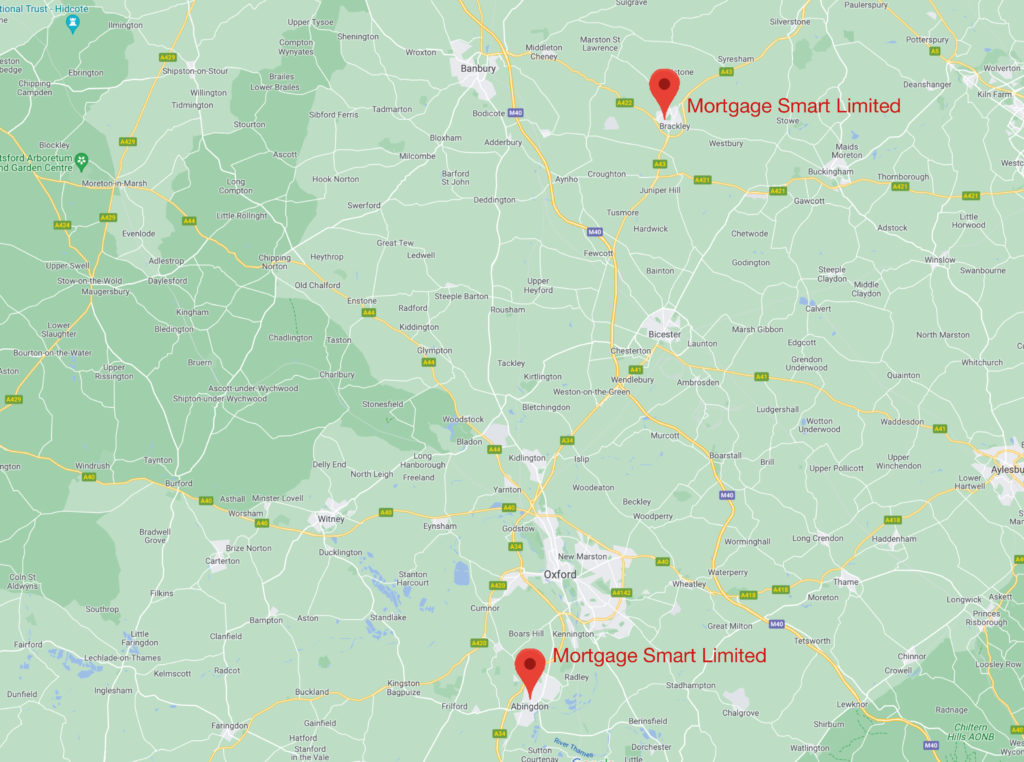

Brackley call: 01280 313163

Abingdon call: 01235 933225